Exploring Options: Can Former Bankrupts Secure Credit Report Cards Adhering To Discharge?

Browsing the monetary landscape post-bankruptcy can be a complicated job for people looking to reconstruct their credit history. One typical concern that develops is whether former bankrupts can successfully obtain credit score cards after their discharge. The solution to this inquiry involves a complex exploration of various factors, from credit rating card choices customized to this group to the influence of previous financial decisions on future creditworthiness. By understanding the intricacies of this process, people can make informed choices that might lead the way for a more safe financial future.

Recognizing Charge Card Options

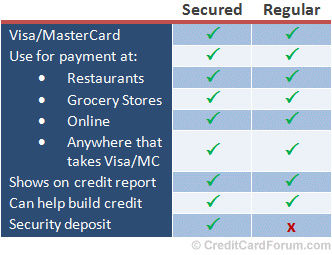

When considering credit history cards post-bankruptcy, individuals have to meticulously examine their needs and economic situation to choose the most appropriate option. Secured credit report cards, for instance, need a cash down payment as collateral, making them a feasible option for those looking to reconstruct their debt background.

Furthermore, people ought to pay attention to the annual percentage price (APR), moratorium, yearly costs, and incentives programs used by various charge card. APR dictates the expense of borrowing if the equilibrium is not paid in full monthly, while the poise period determines the home window throughout which one can pay the balance without incurring interest. Furthermore, yearly costs can impact the total expense of possessing a charge card, so it is crucial to review whether the benefits exceed the costs. By thoroughly assessing these aspects, people can make educated decisions when picking a charge card that straightens with their monetary objectives and scenarios.

Elements Influencing Approval

When requesting charge card post-bankruptcy, recognizing the factors that impact authorization is vital for individuals looking for to reconstruct their monetary standing. One important variable is the candidate's credit report. Complying with an insolvency, credit rating commonly take a hit, making it harder to certify for traditional charge card. Nonetheless, some providers offer safeguarded credit rating cards that need a down payment, which can be a much more possible choice post-bankruptcy. One more substantial factor is the candidate's revenue and work status. Lenders wish to ensure that individuals have a steady income to make timely payments. In addition, the length of time since the personal bankruptcy discharge plays a duty in approval. The longer the duration since the insolvency, the greater the possibilities of approval. Demonstrating accountable financial habits post-bankruptcy, such as paying costs in a timely manner and keeping credit history use low, can additionally favorably influence charge card authorization. Recognizing these elements and taking steps to improve them can increase the chance of safeguarding a bank card post-bankruptcy.

Guaranteed Vs. Unsecured Cards

Protected credit report cards require a cash money down payment as collateral, generally equal to the credit restriction prolonged by the company. These cards normally use higher credit restrictions and reduced rate of interest prices for individuals with great credit score scores. Eventually, the option in between safeguarded and unsecured credit history cards depends on the individual's monetary circumstance and credit score objectives.

Building Debt Responsibly

To properly restore credit score post-bankruptcy, developing a pattern of responsible credit history application is crucial. One crucial way to do this is by making timely settlements on all charge account. Payment background is a substantial aspect in determining credit history, so guaranteeing that all costs are paid on schedule check over here can gradually improve credit reliability. Additionally, keeping bank card balances reduced loved one to the credit history limitation can favorably impact credit rating. secured credit card singapore. Professionals suggest keeping credit score usage listed below 30% to demonstrate liable credit score administration.

Another approach for constructing debt sensibly is to check debt records routinely. By reviewing credit reports for errors or indications of identification theft, people can attend to concerns immediately and maintain the accuracy of their go to this site credit rating. Furthermore, it is a good idea to refrain from opening numerous brand-new accounts at once, as this can signal financial instability to possible lending institutions. Rather, concentrate on progressively expanding charge account and showing regular, liable credit behavior gradually. By adhering to these methods, individuals can progressively restore their debt post-bankruptcy and job towards a healthier economic future.

Gaining Long-Term Perks

Having actually developed a foundation of accountable credit rating monitoring post-bankruptcy, people can currently concentrate on leveraging their boosted creditworthiness for lasting financial benefits. By consistently making on-time settlements, keeping credit application reduced, and checking their debt records for precision, previous bankrupts can progressively restore their credit history. As their credit rating enhance, they may end up being qualified for much better credit report card supplies with lower interest prices and higher credit rating restrictions.

Reaping long-lasting advantages from boosted creditworthiness prolongs past simply credit cards. Furthermore, a positive debt account can enhance job leads, as some companies may examine credit score records as part of the employing process.

Conclusion

Finally, former bankrupt people may have difficulty protecting charge card adhering to discharge, however there are options available to help restore credit history. Comprehending the various kinds of bank card, variables impacting approval, and the significance of accountable charge card usage can assist people in this scenario. By selecting the right card and using it sensibly, previous bankrupts can progressively improve their credit rating and reap the long-lasting benefits of having accessibility to credit score.

Showing liable economic actions post-bankruptcy, such as paying expenses on time and article source keeping credit score usage low, can additionally positively affect credit history card authorization. In addition, maintaining credit card balances reduced loved one to the credit report limit can favorably influence credit score ratings. By continually making on-time settlements, maintaining credit rating application reduced, and monitoring their credit report reports for precision, previous bankrupts can slowly restore their debt scores. As their debt scores enhance, they might come to be qualified for far better credit rating card uses with lower passion prices and greater credit rating restrictions.

Comprehending the different types of credit rating cards, aspects influencing approval, and the relevance of accountable credit history card use can aid people in this circumstance. secured credit card singapore.